Beyond Colombia, the stock markets of Chile, Peru, Mexico and Brazil all posted annual gains of over 45%, making Latin America the standout performer globally in 2025.

Analysts noted that the sharp rally in Colombia’s stock market is the combined result of three factors: a low valuation base, concentrated sector weighting in the index, and improving investor sentiment.

Todd Jablonski of Principal Global Investors commented, “Colombia’s stock market was valued at a historic low at the start of 2025, with severely underweight capital allocation. As such, even a small inflow of capital was able to drive a substantial surge in stock prices.”

The MSCI Colombia Index has an extremely high weighting in the financial sector, particularly the dominant share of the country’s largest bank, which further amplified the market’s gains.

Political expectations have further boosted market optimism. Colombian President Gustavo Petro is ineligible for re-election, and investors are increasingly optimistic that the government will shift toward more market-friendly policies going forward.

Cambridge Associates pointed out in its year-end report: Emerging market equities delivered a strong performance in 2025 and are on track to outperform developed markets for the first time in five years.

The institution projected that this trend will extend into 2026, supported by three core factors: stock and exchange rate valuations trading at deep discounts, robust upward market momentum, and continuous improvement in macroeconomic fundamentals. Latin American stock markets are currently valued near a 20-year low, with regional currencies priced attractively—real exchange rates are approximately 11% below their long-term median levels.

Alejandro Arreaza, Latin America economist at Barclays, stated, “Colombian assets still carry a high political risk premium. There is room for this premium to decline in the future, leaving upside potential for the stock market.”

Supported by central bank interest rate cuts and domestic economic growth ranging from 2.5% to 3%, the Colombian peso appreciated nearly 15% against the US dollar over the year, with the exchange rate standing at 3,744.3 pesos per US dollar.

Dominic Paparazzo, chief multi-asset strategist at Morningstar, said, “The significant appreciation of the Colombian peso against the US dollar this year has been a key driver behind the stock market’s impressive total returns.”

Danish Market: Leading Global Declines, Dragged Down by Blue-Chip Stocks

The lackluster performance of Denmark’s stock market stands in stark contrast to the broader strong rally across Europe.

Sutanya Chetchotisak of UBS European Equity Strategy noted, “The extremely concentrated sector weighting in the index is the core reason why Denmark’s stock market ranks among the worst globally.”

Novo Nordisk accounts for approximately 40% of the MSCI Denmark Index, effectively reducing the index to a “shadow of a single stock.”

She bluntly stated, “When a stock with a 40% index weighting plummets, the benefits of diversification are negligible.” Novo Nordisk’s share price plunged nearly 48% over the year, weighed down by US pricing disputes over GLP-1 drugs, fading prospects for its R&D pipeline, and downward revisions to earnings expectations.

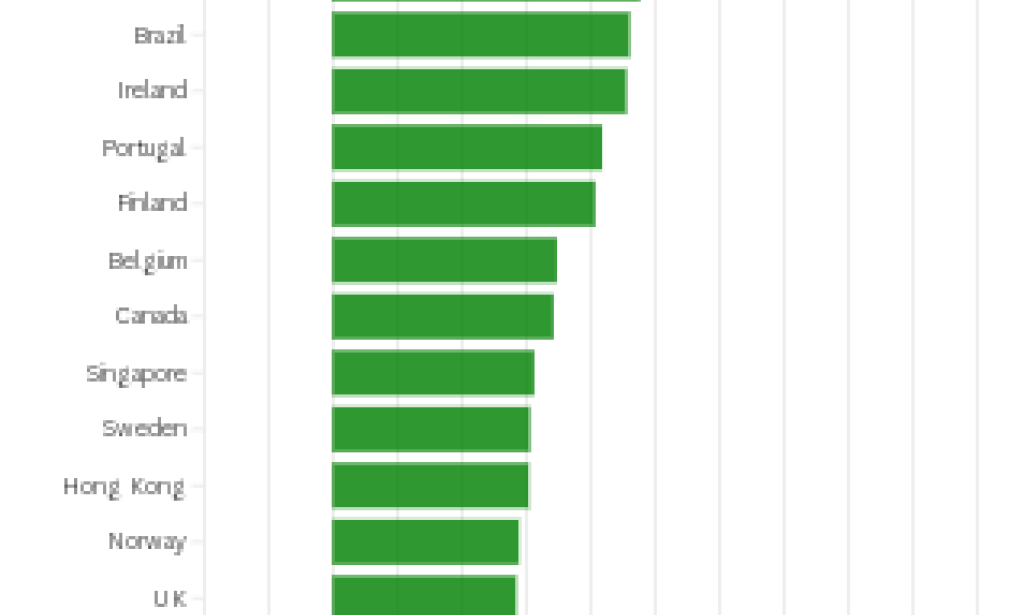

In contrast, other European markets—including Hungary, Spain, Austria and the Czech Republic—recorded impressive gains, ranking among the top performers globally.

Strategists indicated that despite concerns over escalating trade frictions and euro appreciation, the European stock market rally has been driven by better-than-expected economic recovery, inflation edging closer to the European Central Bank’s 2% target, and current interest rate levels providing strong support for banking sector profits.

Bjarne Breinholt Thomsen, head of cross-asset strategy at Danske Bank, pointed out that countries with a high banking sector weighting have been the biggest beneficiaries of this rally. The STOXX 600 European Banks Index surged around 65% in 2025.

“Stock markets in smaller European economies inherently have higher sector concentration. Markets with a large financial sector weighting thus benefited in 2025, in sharp contrast to Denmark’s market structure dominated by the healthcare sector,” Thomsen added.

Thomsen stated that Europe’s “catch-up rally” in equities may have concluded, but the market fundamentals will remain favorable in 2026, with sustained economic growth improvement and inflation approaching the target level. While 2026 returns may fall short of those in 2025, the overall environment will remain supportive, with cyclical sectors such as banking continuing to benefit from steady economic growth and a recovery in credit demand.

Asian Market: Mixed Performance, South Korea Leads, Outlook Tied to Policy and AI

In comparison, Asian stock markets delivered a mixed performance in 2025. South Korea’s stock market soared by approximately 80%, ranking second globally in terms of gains; markets including India, Thailand and Malaysia recorded only single-digit growth.

The sharp rally in South Korea’s stock market was driven primarily by the strong performance of tech blue chips.

Rowling Chan, director of equity research at Morningstar, commented, “South Korea’s outperformance is largely attributed to the recovery in Samsung Electronics’ share price and the continued strength of SK hynix.” Combined, these two companies account for over one-third of the weighting in South Korea’s benchmark stock index. They have benefited from rising memory chip prices and optimistic market expectations regarding improvements in their shareholder returns.

Deutsche Bank projected that the outlook for Asian equities in 2026 will hinge on policy flexibility, exchange rate trends, and the sustainability of AI-related demand. It also warned that as global trade momentum weakens, earnings expectations in some Asian markets may face downward revision risks.

Goldman Sachs and State Street Global Advisors, however, believe that Asian market fundamentals will continue to improve in 2026. Goldman Sachs noted that Asia will benefit from accommodative global financial conditions, renewed fiscal policy momentum (particularly in China and Japan), and a gradual recovery in domestic demand. Among these, the Japanese market will emerge as a relative bright spot in the region, supported by corporate reforms, wage growth, and increased capital expenditure.

US Stock Market: AI and Consumption Underpin Growth, Modest Gains but Record Highs

Major financial institutions stated that despite concerns over AI bubble risks, AI-driven earnings growth and resilient consumer demand remained the core drivers of the US stock market rally in 2025.

Morningstar data showed that US equities posted moderate gains of only 16% in 2025, underperforming other major markets. Nevertheless, led by large-cap tech stocks, both the S&P 500 Index and the Nasdaq Composite Index hit new all-time highs.

State Street pointed out that strong corporate capital expenditure, particularly among tech and infrastructure-related firms, has underpinned the US stock market rally, even as US equity valuations have risen to historic highs.

Looking ahead to 2026, the US stock market outlook is generally positive, but stock selection will become more challenging. Goldman Sachs projected that supported by increased AI investment and accommodative monetary policy, US corporate earnings will continue to grow, yet high valuations and index concentration risks may constrain upside potential.

State Street echoed this view, noting that the US will remain the core engine of global equity returns, but warned that market sensitivity to earnings performance, policy changes, and a slowdown in AI-related spending will rise significantly, requiring investors to adopt a more prudent approach to stock selection.

You must be logged in to post a comment.