2025.04.10 16:18 (Updated 2025.04.10) | Togo

Investing requires hard work; it's about basing your decisions on fundamentals, not blindly following the crowd or believing in insider tips circulating in the market.

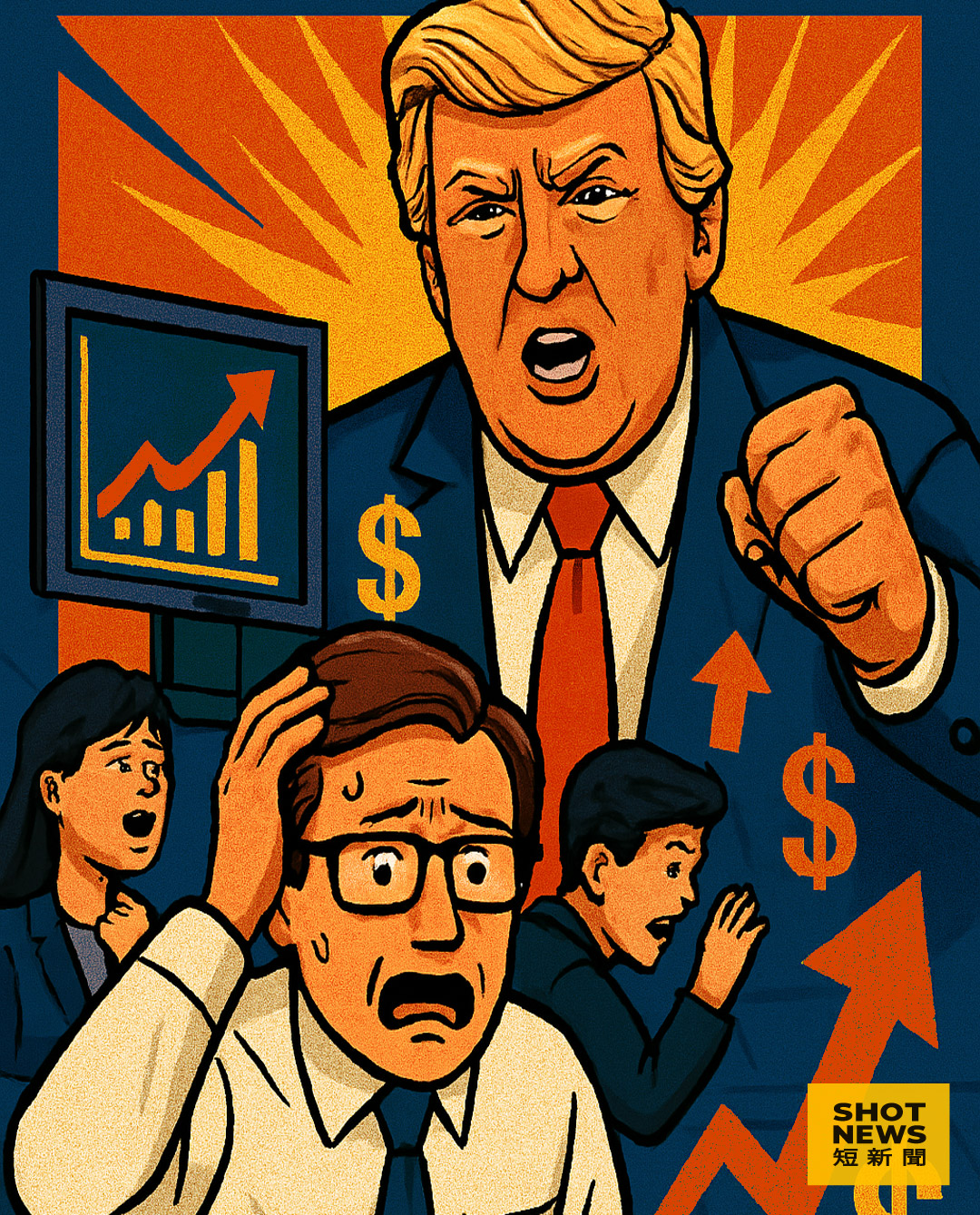

Is the Taiwan stock market making a comeback?

Taiwan stocks fell by about 4,000 points for three consecutive days. Good and bad stocks alike could not escape the fate of hitting the daily limit down. But just when investors were in despair, they surged by more than 1,600 points on Thursday. The largest drop and the largest rise in the history of Taiwan stocks both occurred within a week.

The initial drop in stocks was followed by a rebound, with the decline narrowing to just over 10%, but this resulted in numerous tragedies. Because the first three days saw such a large drop, and the situation seemed unlikely to improve, many leveraged traders were forced to liquidate their positions, losing everything. Margin trading losses reached 78 billion yuan in those three days, equivalent to approximately 180 billion yuan in margin-traded stocks. Adding those who didn't use margin trading and sold at a loss, the total trading volume exceeded one trillion yuan. Consequently, the stock market was a scene of widespread despair, with many losing investors banding together for mutual support.

Even more tragically, just as these people were being bloodied and humiliated, the situation reversed overnight. Trump suddenly announced that tariffs on Chinese goods would be raised to 125%, a direct confrontation with China, but retaliatory tariffs on over seventy other countries that did not retaliate against the US and were willing to "lick his boots" would be suspended for 90 days. This announcement sent US stocks soaring, and Taiwan stock index futures even hitting their daily limit in overnight trading. The next day, almost all Taiwan stocks again hit their daily limit, meaning the opening price was essentially the closing price. While this certainly encouraged the die-hard bulls who were still holding on to the stock market, those who had been executed in the stock market were heartbroken and filled with regret.

This week's stock market rollercoaster offers several important lessons: First, it's best to avoid using leverage and expanding credit in investing. While leveraged trading may generate multiplied profits, a sudden stock market crash can wipe out all gains, leaving you with nothing, or worse, your assets completely wiped out. Second, investment should prioritize value investing, which involves industry outlook and the character and competence of business operators. In other words, investing requires hard work, basing your decisions on fundamentals, rather than following the crowd or blindly believing in market rumors.

Investing in stocks requires more than just economics; psychology is even more crucial. Only those with strong mental fortitude can enter the market bravely when others are fearful, remain vigilant when others are greedy, and decisively exit to lock in profits and avoid risks.

In fact, these principles are like outdated investment clichés that are usually not taken seriously. However, when the stock market crashes, like the global stock market crash this week, we will realize that they are the key to successful investing.

You must be logged in to post a comment.