The Internal Revenue Service (IRS) issued guidance that nudges the US a step closer to allowing crypto exchange-traded investment products to share staking rewards with investors.

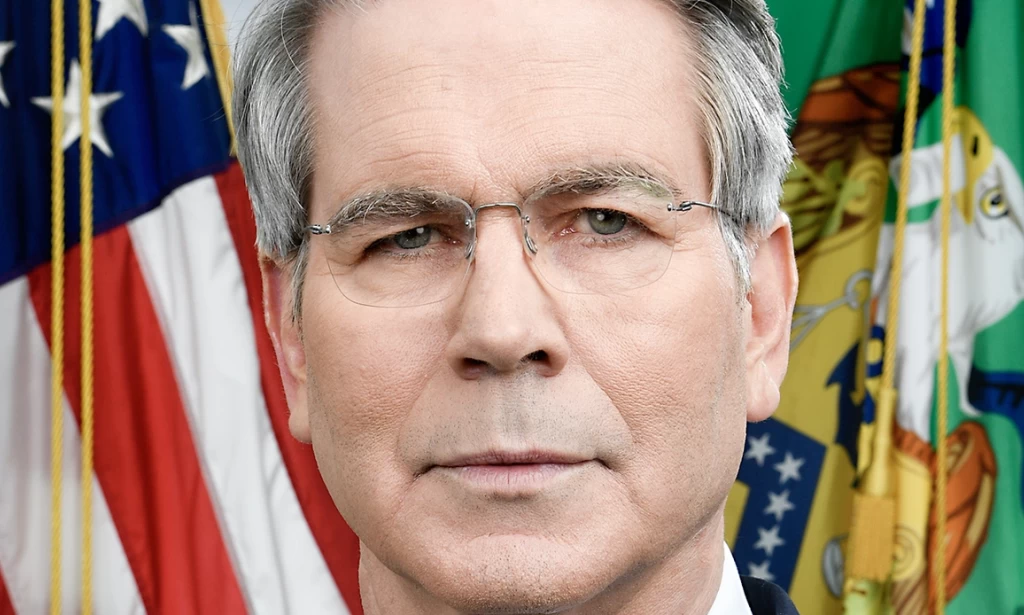

Scott Bessent, Secretary of the US Treasury, noted on X on Monday that the guidance gives a “clear path to stake digital assets and share staking rewards with their retail investors.”

“This move increases investor benefits, boosts innovation, and keeps America the global leader in digital asset and blockchain technology,” he added.

Safe habour

The IRS created a safe harbour that lets certain crypto exchange-traded products (ETPs) stake Proof-of-Stake tokens without losing their pass-through tax treatment. The measure applies to vehicles organized as “grantor investment trusts” – passive funds that hold assets for investors and are taxed directly in the hands of those investors – so long as they meet certain conditions.

According to Bill Hughes, the senior counsel at Consensys, a blockchain software company, the five criteria for trusts to stake digital assets are to:

- Hold only one digital asset type and cash;

- use a qualified custodian to manage keys and execute staking;

- maintain SEC-approved liquidity policies ensuring redemptions can occur even with staked assets;

- keep arms-length arrangements with independent staking providers;

- and limit activities strictly to holding, staking, and redeeming assets—without discretionary trading.

Risk removal

The market for Ether ETPs is already sizable and growing. However, spot Ether ETFs that launched since the spring of 2024 have done so without staking. This clarity from the IRS removes a key tax risk just as exchanges and issuers are asking the US Securities & Exchange Commission (SEC) to allow staking features in existing financial products.

The revenue procedure also aligns with the SEC staff’s statement in May that “protocol staking” itself is not an offer or sale of securities, which will be helpful clarity once the government shutdown comes to a close and the SEC can resume acting on registration and requests rule changes again.

European reference

US investors can observe their European neighbours as a reference point. European ETPs such as 21Shares’s Ethereum Staking ETP and CoinShares’s Physical Staked Ethereum ETP already share staking rewards with holders. The US safe harbour is designed to let trusts do something similar – participate in validation while staying “pass-through” for tax – subject to certain conditions.

The guidance “transforms staking from a compliance risk into a tax-recognized, institutionally viable activity, accelerating mainstream adoption across proof-of-stake blockchains,” Hughes concluded.

You must be logged in to post a comment.